|

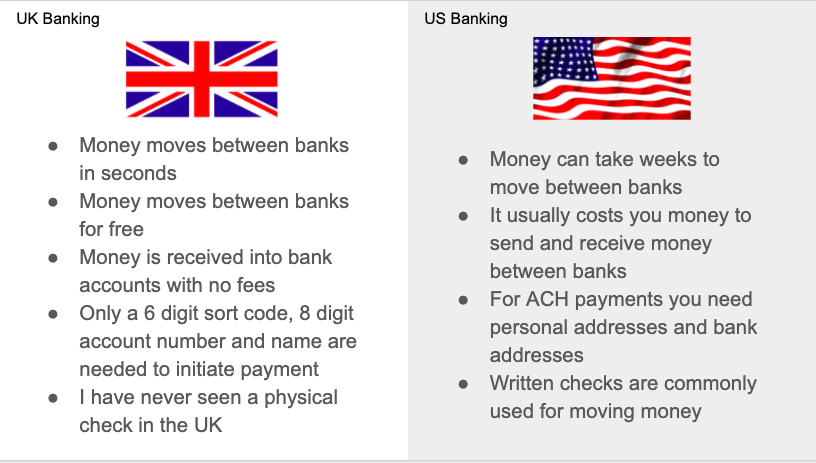

Version 4 - Last updated 14 Feb 2020 Full disclosure I’m going to write about banking and moving money. Not only that but this whole adventure is inspired by the hair-loss inducing frustration I experience when I try to move money between banks in the US. Seems odd am amirite? Well not if you were brought up on the sweet sweet nectar that is the UK banking infrastructure. So if you’re curious as to how they compare, and how America may one day be, and how together we can build a bank to change every aspect of your life - read on. Over the past year and a half I have spent a considerable amount of time researching, thinking about, and (not joking) pulling my hair out due to - the US banking system. More specifically, the completely slow and outdated way that Americans and American businesses move money. At first it was a thanksgiving 2018 vision, that the US payment infrastructure was never going to change, and that done the right way - one could build a bank so incredible that it removes the US payment infrastructure entirely. After considering just how ambitious an idea it was it became more of a topic of deep thought and discussion to be shared with anyone that would hear me and add to the thoughts jumbling up my mind. This growing body of debate, and ideas and feedback and visions led me to phone calls with the CEO’s of publicly listed fintechs, breakfasts with fintech VCs and even an application to YC with the sole purpose of getting the attention and feedback of the Collison brothers. As the year draws to an end, I have embraced the reality that this isn’t something I can pull off today. Without silicon valley’s VCs in my back pocket I don’t believe I can get close to enough capital raised to even make a go of it. And while I sadistically LOVE to run towards the hardest challenge possible. I know that my meagre 2 months of living here (Mountain View, California) is simple not enough to carry any network weight to be of use in fundraising. I am however more galvanised than ever that the system is a mess and so I committed to myself that I would publish the high level overview of what I spent the year looking into as well as some of the key features I believe will make it possible. I will try and maintain this post as more and more people discuss and add to it, such that if you’re working on a bank/payment infrastructure in the US you can skip a few steps and make life easier for the rest of us. It all starts here. Moving money in the UK vs moving money in the US. As a CFO, but also as a member of the general population here was the stark contrast in experiences that kicked off my frustration in the US: The difference in the speed and cost at which you can move capital alone, threw me. How does it come to pass that, it is acceptable to handover a piece of inked paper in lieu of payment in the worlds strongest economy. Let alone the fact that Checks have an effective transactional cost of 9%, checks can take actual weeks to clear (when they clear) and there are real and accepted eventualities where the check bounces. For a country full of smart, productive and energetic people - I am amazed that Americans put up with such a terrible system. On the micro side If you can shorten this gap to seconds, you would be creating a financial system that works for the lower tiers of society more. People who need to max out credit cards, pawn their stuff, take payday loans would no longer need to. People for whom the fees to send and receive money have an impact beyond the 1% & 2% you might think of for credit card payments, but can lose as much as +10% of the value of a payment in transaction costs. The simple difference of getting paid instantly and for free vs a bunch of days can dramatically improve someone's life. On the Macro side, if you move capital in seconds not weeks, you are increasing the liquidity of capital and the velocity of money dramatically. You’d be unlocking, virtually free, economic growth. Can you imagine building a singular business that had such an impact? Mind melting right? Well that’s what drew me in. Below is a mixture of a roadmap I drew up, my YC application and notes I’ve taken from various phone calls. If anything doesn’t make sense, is wrong, could be done better - please do reach out. I am 100% down to be wrong and to get better. Isn't America already changing?This is the first question I get asked every time. Well that and "come on I think you're doing banking wrong?". This one come from people in the UK. Can you imagine explaining a system to archaic people think you have fundamentally misunderstood how it works. It's like trying to discuss how in Italy 86% of transactions are settled in cash. Rent? Cash. Electricity bill? Cash. Mortgage? Cash. "Wait - I think you've missed something there". Mind melting yet? While the UK enjoys radically progressive banking rules and a forward thinking and straightforward banking regulator, America does not. To simply sit back and say Faster payments or any other system will eventually come here, is like saying Blackberry will eventually put the iPhone in the ground in 2009. We know how that turned out. The Faster Payments Task Force was convened by the Federal Reserve in May of 2015 (5 years ago at time of writing this) and not only does Faster Payments not exist in the US yet, but a US equivalent is tabled for implementation in 2024 by the Fed. I am willing to bet that that target date will be missed. Nothing I have seen gives me hope that this will be implemented and rolled out by the end of the decade. So is America magically going to fix this problem at the infrastructure level? I think not. Well what would you propose?Thanks for asking Matt. If the foundational infrastructure is broken what is there to do? Paypal, Venmo and the likes have built their own digital wallets which circumvent the existing banking infrastructure for everyday people. The fees are too high for my liking but the model... the model is just what we need. By having our own platform/wallet/bank that holds all of the players' money we no longer have to send money along a rail between accounts. Money movement is simply an accounting entry. We already have banks. How is yours special?I propose building a digital banking platform that sits on top of the existing infrastructure to allow for money to move digitally between accounts in seconds rather than weeks. Mobile first, with new identification technology, customers should be able to open accounts through their phones in minutes and have cash in bank in seconds. If you can build a banking platform that acts as an external central bank (obviously not a central bank but it operates similar to the Fed, where customers are you members) you can cut out the existing payment networks and save customers an incredible amount of money and time by simply moving money between accounts in the same bank. To be clear - for this to work, everyone who wants to enjoy free, immediate money transfer needs an account with the bank. Pause - I want to be clear here. What I am proposing is a bank where everyone has an account. Then what happens is - when you send money to someone or your employer goes to pay you - all the happens is a bank writes an accounting entry that says $XX in its account used to belong to your employer, but now belongs to you. Ambitious challenge - is it worth it?The market is huge in 2016 alone 148.1 million Fedwire transfers were valued at $766.7 trillion. Our new bank, lets call it Molasses (pun intended) would totally reshape the way people manage money (think less pay day lenders), businesses manage money (think less time fretting about making ends meet, less bank loans) and would increase the velocity of money in a way that would be transformational to economic growth. With that much money on the table - surely others are working on this.Hey I am open to being pointed in their direction. I want them to succeed. As of yet however, I have not seen anyone tackling it in this way, let alone tackling it. Banking is on trend at the moment in the valley but more in the approach that billion dollar banking products can be built by segmenting the bank customers into unique product groups (think farmers vs Uber drivers). Business banking is hot too in the last yea alone we've seen the rise of:

For the most part these companies are playing within the rules of the existing infrastructure. What you're suggesting is insane - how would you have a fighting chance?You're right. I'm a little crazy. I'd be lying if I didn't say that pulling this off is nearly impossible. However come on a journey with me and see how we might do it? There are some core features/wins that I believe someone building Molasses (our bank name remember? It's a joke about speed guys) would need to get right in order to make this successful.

Large Network ReachLet us remember, we're building this bank to circumvent the payment networks. The existing payment networks are plugged into every bank account in the US (pretty much) and so we would need to emulate this in the closest way possible to make this work. Well that would mean that we need a way to acquire and onboard new bank account holders faster than anyone has ever done before in history (Paypal-esque). Typical checking account CACs (Customer Acquisition Costs) range between $100-$200 and it has been said that you are more likely to change your spouse more often than your primary checking account. Fun challenge right? Well I've witnessed first hand what Monzo has managed to do in the UK effectively growing to +2million account holders with next to nothing spent on marketing. I believe that this is doable from an awareness standpoint, there are some cheeky hacks we can add in like tagging the transaction descriptions on everything as "As fast as Molasses" etc. The main acquisition challenge is that onboarding to a new bank account in the US is an exhausting process while jumping through KYC (know your customer) and AML (Anti Money Laundering) hoops. However - you will have had to jump through those hoops to have an existing account right? So if Molasses can verify that you have an existing account, we can lean on another banks due diligence to temporarily open and fund your account. Then over a series of days/weeks you can add more information as needed and we can lift the restrictions on your account. Account sign up and creation could feasibly take place in a few taps and a few minutes. I mean given how bad existing user experiences are - you could grow simply by targeting SVB (Silicon Valley Bank) customers with some tagline like "Finally a use for your SVB account" Large network TICK! Ghost Direct Debit SystemThis leans a little into how Molasses will make money, but basically - the super power of instant and free money movement is direct debits. With a direct debit network consumers can automate investment habits, bill paying and so much more. Businesses can accept subscription payments in the form of bank transfers. Let's say Molasses charges businesses 0.05% for these transactions. This lowers costs, these can be passed on to the purchasers. Automated direct debits can remove financial admin time too. No more fretting of getting payments submitted by a certain time. This also allows for customers & businesses to easily request money. Requesting money easily would allow for two things to happen:

That sending money to the wrong place thing is a real problem in the US by the way. Ghost Direct Debit TICK New Credit ScoringWith proprietary data on income, spending habits and cash balances Molasses is then in a place to develop its own credit scoring system. Now this wouldn't be done just for fun, but for what credit scores are meant for. The evaluation of credit risk. With real time credit risk businesses can factor their invoices almost instantly creating more liquidity. Businesses will also know whether their suppliers/customers are risky or not, allowing them to adjust pricing/terms accordingly. Instant, free money movement and a new credit scoring system would fundamentally change the fabric of how businesses and consumers deal with their finances and spend their money - for the better. Less fraud, less uncollected payments, less risk. Where would you start?Currently banking simply isn’t fit for purpose. There are a tonne of ancillary services and products that can be built and given away for free which I think financial decision makers (CFO’s) would eat up like wildfire. Take contractor details for example, so many Americans are scared of giving out their SSN and bank details (somewhat understandably so). In my org we end up storing these in an airtable. You make this much more secure and faster if integrated with the banking platform. Working with VC’s and startup ecosystems to seed the network under the guise of moving capital faster, more securely and freely could also be an interesting GTM. You could also start with the large hourly workforces. Shaving even just a day off of payment settlement times for them would have such a dramatic effect. I.e. Uber, Lyft, Instacart, Amazon delivery, UPS. Settling in seconds would become a strategic recruiting edge. If Uber put ride fares in your account within seconds and Lyft takes weeks - who are you going to drive for? Conclusion - The light of dayWell now it's out there in the light of day. I believe ideas should be shared and debated openly. Only by writing these out can I structure my thoughts better. Only by sharing them can they help people. Only by being read can they be verified, torn apart and improved.

This was a tough one to write. I was torn on whether I should publish my YC application, call notes, product specs and roadmap separately or whether I should blend them in to a fintech soup like I have. Big mistake? You tell me. Update: I really did not expect to receive as many call requests on this as I did. Thanks to all those who helped with updates, suggestions and who got me on the phone just to explore what was possible.

4 Comments

Jhon

26/11/2023 11:23:19 am

Your post offers practical tips for leveraging social media platforms like Instagram or TikTok to build a personal brand and attract opportunities for sponsored content, partnerships, or endorsements. It's a way to monetize your online presence. <a href="https://www.toprevenuegate.com/fm99c4i9zx?key=e52491a8eb9d2041b8149631fcce066e" target="_blank">click here</a> for more insights.

Reply

John

5/12/2023 08:00:31 pm

Your post emphasizes the importance of providing exceptional customer service and building strong relationships with your clients when pursuing money-making opportunities. It's a way to create repeat business and attract referrals. For more details, <a href="https://www.toprevenuegate.com/vdijcm9sv?key=2c91be5c093c089aa3428dc09ce8cde6" target="_blank">click here</a>.

Reply

Leave a Reply. |

Archives

June 2024

Categories

All

|

RSS Feed

RSS Feed